The Shine That Never Fades

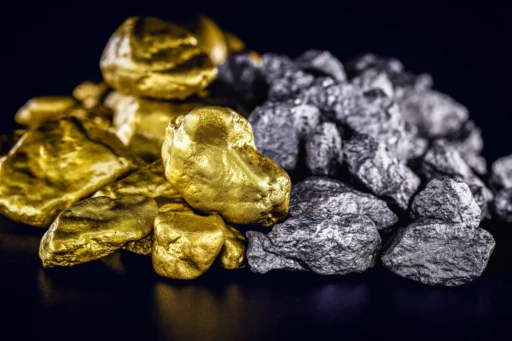

In a world where markets fluctuate and currencies lose value, gold and silver remain timeless symbols of wealth. These precious metals have not only stood the test of time but have also proven to be powerful tools for wealth preservation and profit. Whether you’re a cautious investor or a risk-taker, investing in gold and silver can balance your portfolio and secure your financial future.

1. Why Gold and Silver Are Smart Investments

Gold and silver are real assets — they’re tangible, finite, and globally recognized. Unlike stocks or crypto, they aren’t tied to a company’s performance or government policies. Their intrinsic value and scarcity make them ideal safe-haven assets during economic downturns.

- Gold offers stability and is less volatile.

- Silver, on the other hand, offers affordability and greater upside potential due to its industrial demand in electronics, solar energy, and EVs.

2. The Profit Potential: Then and Now

Over the years, both metals have delivered impressive returns:

- Gold has appreciated more than 450% in the past 20 years, outperforming most currencies.

- Silver, though more volatile, often provides higher percentage gains during bull markets.

In 2025, as inflation persists and global uncertainty rises, experts predict another upward trend for both metals. Smart investors are already increasing their exposure.

3. Beating Inflation the Smart Way

One of the greatest advantages of investing in gold and silver is inflation protection. When prices rise and purchasing power declines, precious metals tend to appreciate, preserving your wealth. That’s why central banks and billionaires consistently hold gold in their reserves.

4. Different Ways to Invest

You don’t need to buy physical bars to invest. Here are popular ways to gain exposure:

- Physical bullion or coins (for direct ownership)

- ETFs (Exchange-Traded Funds) for easy trading

- Mining stocks for higher risk and higher reward

- Digital gold/silver through trusted online platforms

Each method carries unique risks and benefits — your choice should align with your risk appetite and investment goals.

5. Long-Term Strategy for Steady Profit

Investing in gold and silver isn’t about quick profits — it’s about long-term wealth preservation. Experts recommend allocating 10–15% of your portfolio to precious metals. Over time, this hedge can smooth out volatility and provide consistent growth.

Conclusion: The Future Still Glitters

As global economies face uncertainties, gold and silver continue to shine as reliable stores of value. They’re not just ancient relics — they’re modern-day financial armor. If you seek stability, safety, and sustainable profits, investing in these metals could be your smartest financial move in 2025.

#GoldInvestment #SilverInvestment #WealthBuilding #SmartInvesting #InflationHedge #FinancialFreedom #PreciousMetals #LongTermProfit #InvestInGold #InvestInSilver